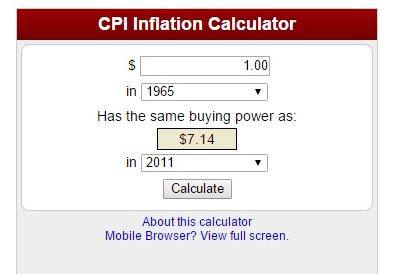

- Based on the US CPI Inflation data, the purchasing power of 1 dollar in 1965 becomes 1/7.14 = 0.14 dollar in 2011.

- That means the US dollar has fallen 86% during that period.

- The average annual inflation rate is about 4.2% from 1965 to 2011.

- (1-4.2%) ^ 46 = 14%

- Under the US government Expansionary Monetary Policy, the inflation will continues into the future, and some of the years it will become out of control (like in year 1980)

- The inflation will eat up, in high living costs, your income, and your cash.

- Here is the official inflation calculator.

- Precious metals (gold and silver), diamonds, paintings by masters, rare stamps and coins, etc. This is not a good option. You should avoid this type of non-productive investment.

- Government bonds or high grade corporate bonds. These will partially protect you from inflation. This is a better-than-nothing option, but far from the best option.

- Real estate. Usually this will at least protect you from inflation. If you buy the real estate in an economic depression period, you will do pretty well. The risk is, if you pay too much on an overvalued real estate, you will be in losing-money status and have to wait for a long time to become profitable. In addition, your borrowing capacity sometimes limits your investment ability in this area.

- You are doing business. If your business is stably profitable your money will be protected automatically. The risk is your business may lose money or even get bankrupt.

- Common stocks. This is the best option. The risk is you may end up losing money if you don't have the necessary common stock investment knowledge (even if you think you have). But with some basic investment methodology, you can do very well in this option.

Positive Side

- You can make a decent return from investing on common stocks.

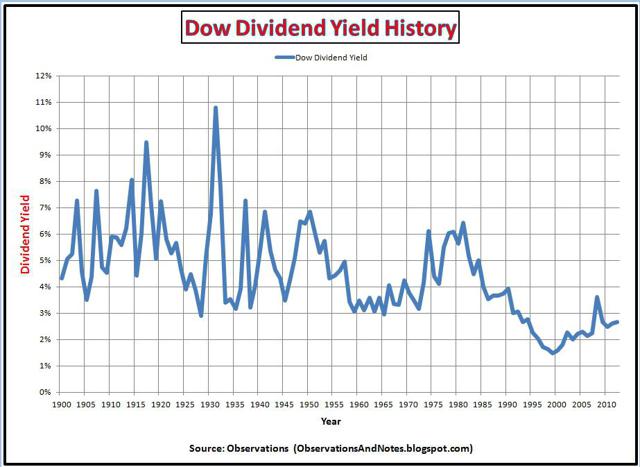

- In the last century from year 1900 to 2000, the Dow Jones Industrial Average (DJIA) rise from 66 to 11497. The average annual return is 5.3%. In addition, the average dividend yield rate from the DJIA is above 3.8%.

- From the following chart you can roughly find out the average DJIA dividend yield rate.

- If your income tax rate is 20% for the dividend, then you will get 3.8% * (1-20%) = 3.04% after-tax return on the dividend. Tax on dividend needs to be paid every year.

- If you invest in DJIA for the last century, your annual return is 5.3%+3.04% = 8.34%. Your total return for the century will be (1+0.0834)^100 = 301220%.

- That means, if you invest $100 in year 1900 on DJIA, you will end up with $301,220 in year 2000. If you don't invest you will simple end up with $100.

- If you can have a solid methodology to get a little better result than DJIA then you can earn a lot more money than the $301,200 because of the compound accumulation. The following are the tables that compare the results of annual return of 10%, 12%, 15% for periods of 100 years and 30 years. (Long term investment can avoid much of income tax as you don't need to sell stocks every year and therefore you don't need to pay taxes every year. For simplicity purpose, we ignore the income tax factor here.)

| Investment During: 100 Year | |||

| Annual Return | Total Return | Beginning Amount | End Amount |

| (DJIA)8.34% | 1.0834^100 = 301,220% | $100 | $301,220 |

| 10% | 1.10^100 = 1,378,061% | $100 | $1,378,061 |

| 12% | 1.12^100 = 8,352,227% | $100 | $8,352,227 |

| 15% | 1.15^100 = 117,431,345% | $100 | $117,431,345 |

| 20% | 1.20^100 = 8,281,797,452% | $100 | $8,281,797,452 |

| Investment During: 30 Year | |||

| Annual Return | Total Return | Beginning Amount | End Amount |

| (DJIA)8.34% | 1.0834^30 = 1,106% | $100 | $1,106 |

| 10% | 1.10^30 = 1,745% | $100 | $1,745 |

| 12% | 1.12^30 = 2,996% | $100 | $2,996 |

| 15% | 1.15^30 = 6,621% | $100 | $6,621 |

| 20% | 1.20^30 = 23,737% | $100 | $23,737 |

I will talk about more on how to invest on common stocks later.

When I was applying for a loan to purchase my building as a small business owner in a tough situation, conventional banks said they could not help me. Mr Pedro, a loan officer, sat down with me, heard my situation and decided that I was worth taking a chance on. Here we are 3 years later and I have just renewed my loan for another 7 years. I couldn’t have purchased my building without the help of Mr Pedro and will be forever indebted to them for giving me a chance when no one else would."

ReplyDeleteI will recommend you to contact a loan officer Mr Pedro on the information below if you need any financial assistance.

Email & Chat: +1 863 231 0632 pedroloanss@gmail.com