Based on that definition here is the equation on how you should calculate your return on investment approximately when you invest on common stocks. (The equation can be used for all types of investments with minor modifications.)

Investment return = (capital gain + dividend) - tax - (bank interest if you save the money in a bank or government bond interest if you invest on the bond) - inflation cost.

Note:

- You have to deduct the tax you need to pay.

- The reason that bank interest (or bond interest) should be considered here is you will get some bank interest if you simply save the money in your bank account.

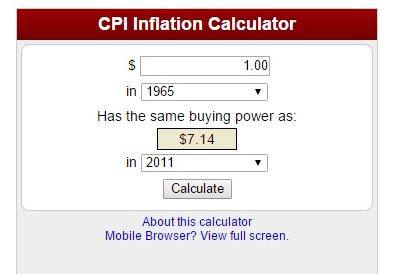

- Inflation cost = your initial principle money * inflation rate. For example, if your initial money is $100, inflation rate is 4.2%, then the inflation cost is $100*4.2% = $4.2.

Example 1:

- Your initial principal money is $100.

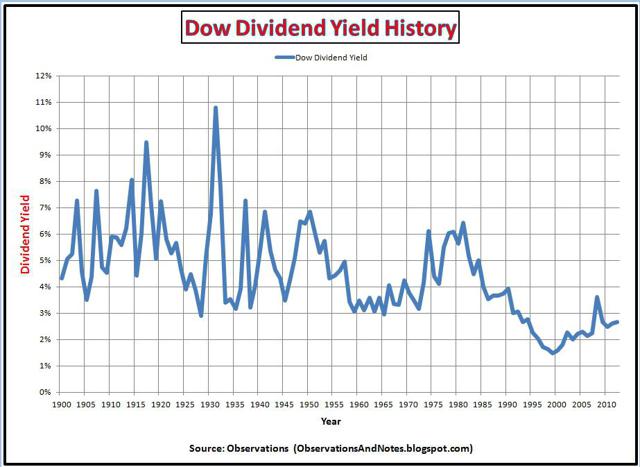

- You earned 3% on capital gain and 3.5% on dividend, therefore you gross return is $100*(3%+3.5%) = $6.5.

- Suppose your tax rate is 20%, and your tax is $6.5*20% = $1.3.

- Suppose bank interest rate is 1.5%, your bank interest would be $100*1.5% = $1.5 if you save your money in a bank.

- Suppose inflation rate is 4.2%. The inflation cost is $100*4.2% = $4.2.

- Your investment return = $7.5 - $1.3 - $1.5 - $4.2 = $0.5

- Your investment return rate $0.5/$100 = 0.5%

Example 2:

- Your initial principal money is $100. Let's say you save your money in a bank to get some interest as investment.

- You earned 0% on capital gain and 0% on dividend, therefore you gross return is $0.

- Suppose bank interest rate is 1.5%, your bank interest would be $100*1.5% = $1.5 if you save your money in a bank. This time your bank interest should be consider as your income and will be added instead of being extracted.

- Your tax rate is 20%, and your tax is $1.5(bank interest)*20% = $0.3.

- Suppose inflation rate is 4.2%. The inflation cost is $100*4.2% = $4.2.

- Your investment return = $0 - $0.3 + $1.5 - $4.2 = -$3.0

- Your investment return rate -$0.0/$100 = -3.0%

Example 3:

- Your initial principal money is $100. You have a profitable business and you invest your money in your business. This example will be more understandable to a business man.

- The average American business needs $5 to earn $1 profit (20%). Let's suppose you have an average business. You earned 20% on the investment capital of $100, which is $20. If your business involves little debt, you can consider the investment capital as equity. The return on equity is 20% in your case.

- Your corporate tax rate is 35%, and your tax is $20*35% = $7.0.

- Suppose bank interest rate is 1.5%, your bank interest would be $100*1.5% = $1.5 if you save your money in a bank.

- Suppose inflation rate is 4.2%. The inflation cost is $100*4.2% = $4.2.

- Your investment return = $20 - $7.0 - $1.5 - $4.2 = $7.3

- Your investment return rate $7.3/$100 = 7.3%

In investment inflation is always an important factor.